關于歐盟最低公司稅率的相關問題解答(中英文對照)

來源:歐盟官網

翻譯:思邁特財稅國際稅收服務團隊

On 18 January 2021, Ministers of the Economic and Financial Affairs Council (ECOFIN) held apolicy debate on the proposal for a directive on ensuring minimum corporate taxation in the European Union. During the debate, the French presidency of the Council, Le Maire pressed for a quick implementation of the global minimum tax( Pillar 2 ) without totally intertwined with the real location of taxing rights between nations ( Pillar 1 ). The questions and answers on this topic as follow.

2021年1月18日,經濟和金融事務理事會(ECOFIN)部長們就一項關于確保歐盟最低公司稅的指導提案舉行了政策辯論。在辯論中,法國理事會主席勒梅爾,敦促迅速實施全球最低稅率方案(支柱2),而不完全與國家之間稅權的重新分配(支柱1)糾纏在一起。關于這個話題的問題和解答如下。

1.To whom do the rules apply?

1.規則適用范圍是什么?

The proposed rules will apply to any large group, both domestic and international, including the financial sector, with combined financial revenues of more than €750 million a year, and with either a parent company or a subsidiary situated in an EU Member State.

擬議規則將適用于包括金融行業在內的任何國內和國際大型集團,每年總收入超過7.5億歐元,且母公司或子公司位于歐盟成員國。

2.How will the effective tax rate be calculated?

2.如何計算有效稅率

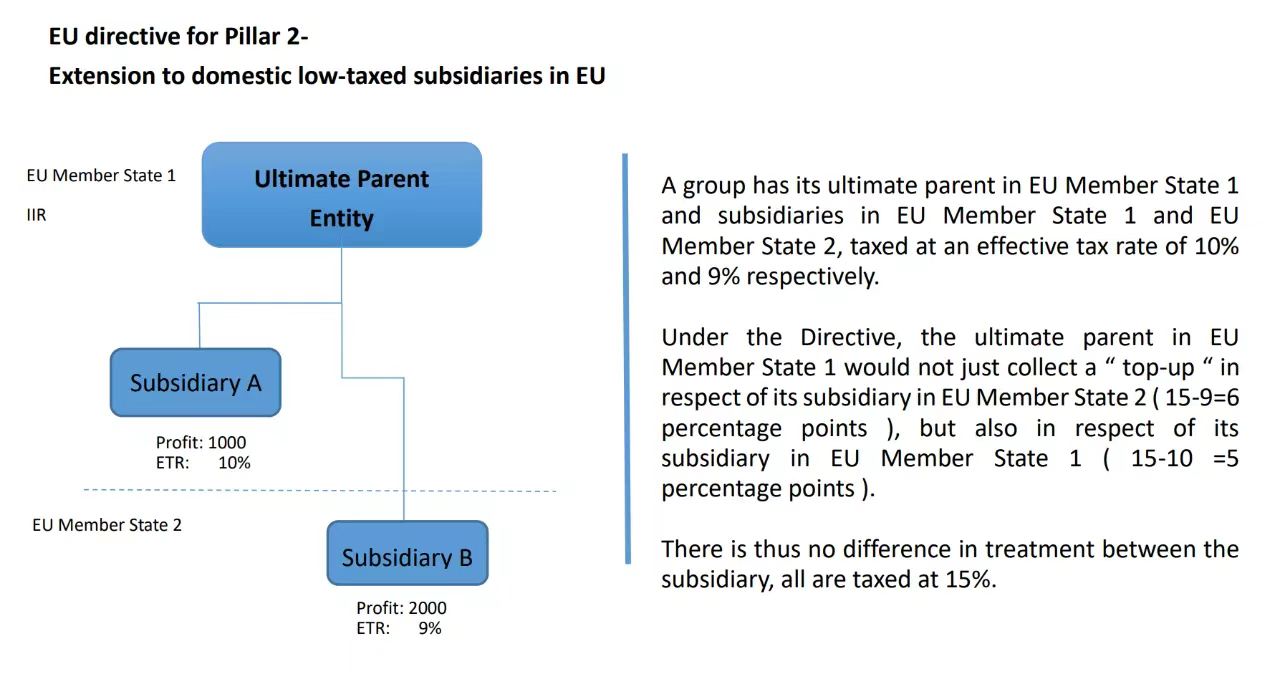

The effective tax rate is established per jurisdiction by dividing taxes paid by the entities in the jurisdiction by their income. If the effective tax rate for the entities in a particular jurisdiction is below the 15% minimum, then the Pillar 2 rulesare triggered and the group must pay a top-up tax to bring its rate up to 15%.This top-up tax is known as the ‘Income Inclusion Rule’ ( IIR ). This top-up applies irrespective of whether the subsidiary is located in a country that has signed up to the international OECD/G20 agreement or not.

每個轄區的有效稅率是由該轄區的納稅主體繳納的稅款除以其應納稅所得確定的。如果特定轄區的納稅主體的有效稅率低于最低稅率15%,那么就會觸發支柱2規則,該集團必須繳納補足稅款,將其稅率提高到15%。這種補足稅款的方式被稱為收入納入規則 (IIR )。無論子公司是否位于簽署了經合組織/G20國際協議的國家,這種補足稅款的方式都適用。

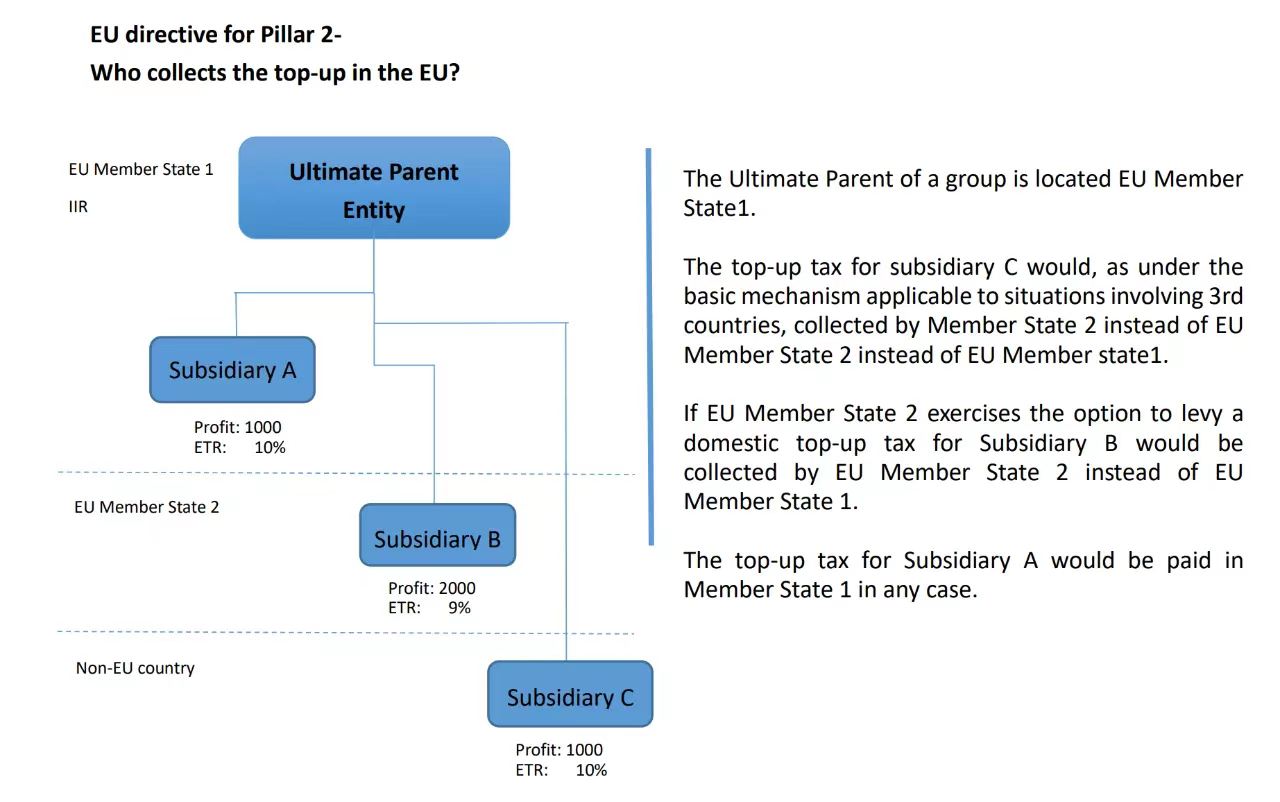

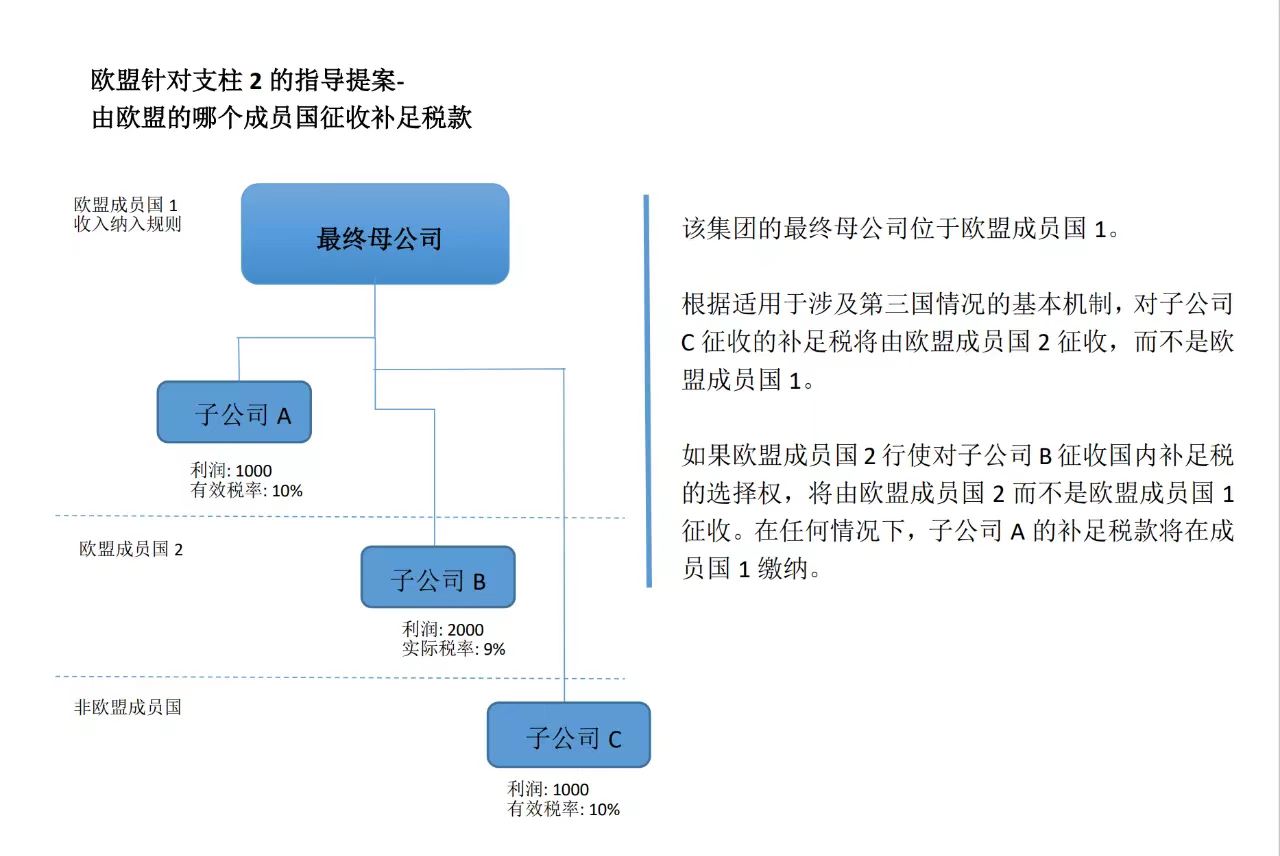

3.Who collects the top-up in the EU?

3.由歐盟的哪個成員國征收補足稅款?

In the OECD/G20 Inclusive Framework agreement, a transparent way of calculating the effective tax rate was agreed by all 137 countries involved. This is reflected in the proposed Directive. The calculations will be made by the ultimate parent entityof the group unless the group assigns another entity.

在OECD和 G20包容性框架中,137個相關國家一致同意了計算有效稅率的透明方式。這反映在擬議的指導提案中。將由該集團的最終母公司進行計算,除非該集團委托另一個母公司。

4.What happens if a group is based in a non-EU country where the minimum tax rate is not enforced?

4.如果一個集團的總部設在一個不執行最低稅率的非歐盟國家,該如何征收補足稅?

If the global minimum rate is not imposed by a non-EU country where a group entity is based,Member States will apply what is known as the ‘Under taxed Payments Rule’. This is a backstop rule to the primary Income Inclusion Rule. It means that a Member State will effectively collect part ofthe top-up tax due at the level of the entire group if some jurisdictions where group entities are based tax below the minimum level and do not impose any top-up tax. The amount of top-up tax that a Member State will collect from the entities of the group in its territory is determined via a formula based on employees and assets.

如果全球最低稅率不是由集團所在的非歐盟國家實施的,那么成員國將適用所謂的“低稅支付規則”,這是收入納入規則的一個補充規則。這意味著,如果某些轄區的集團的稅基低于最低水平,且不征收任何補足稅,則該成員國將有效地征收整個集團水平應繳的部分補足稅。成員國將從其領土內的集團實體征收的補足稅額通過基于雇員和資產的公式確定。

5.Are there any exceptions?

5.有什么豁免?

The rules provide for an exclusion of minimal amounts of income to reduce the compliance burden. This means that when the revenues and the profits in a jurisdiction are under a certain minimum amount, then, no top-up tax will be charged on the profits of the group earned in this jurisdiction, even when the effective tax rate is below 15%. This is known as the de minimis exclusion.

該規則規定排除最低收入以減輕合規負擔。這意味著,當一個轄區的收入和利潤低于一定的最低金額,那么,即使實際稅率低于15%,也不會對該集團在該轄區賺取的利潤征收補足稅。這就是所謂的微利排除規則。

Moreover,companies will be able to exclude from the top-up tax an amount of income thatis at least 5% of the value of tangible assets and 5% of payroll. This is called a ‘substance carve-out’.

此外,如果企業的所得至少是其有形資產價值的5%和工資總額的5%,那么企業將可以不繳納補足稅。這稱為公式化經濟實質排除(即實質經營活動固定回報的扣除)。

The policy rationale for a substance carve-out is to exclude a fixed amount of income relating to substantive activities like buildings and people. This is a common aspect of corporate tax policies worldwide, that seeks to encourage investment in economic substance by multinational enterprises in a particular jurisdiction. This exclusion also focuses the rules on excess income, such asthat related to intangible assets, which is more susceptible to tax planning.

公式化經濟實質排除是扣除與實質性活動(如建筑物和人員)有關的固定數額的收入。這是全世界公司稅政策的一個共同點,旨在鼓勵跨國企業在某一特定管轄區對實體經濟進行投資。該規則也注重對超額收入的扣除規定,例如與無形資產相關的收入,這更容易受到稅收籌劃的影響。

The agreement excludes from the scope income earned in international shipping, as this particular industry is subject to special tax rules. Special features such asthe capital-intensive nature, the level of profitability and long economic life cycle of international shipping have led a number of jurisdictions to introduce alternative taxation regimes for this sector. The wide spread availability ofthese alternative tax regimes means that international shipping often operate soutside the scope of corporate income tax. These exclusions are not going todistort the calculations of the effective tax rate.

但是,由于國際航運是特殊課稅對象,因此不包括在課稅范圍內。國際航運業的資本密集性、盈利水平和經濟生命周期長等特點,使一些轄區為這一行業引入了其他稅收制度。這些替代稅收制度的廣泛存在意味著國際航運通常不屬于企業所得稅的課稅范圍。這些排除不會扭曲有效稅率的計算。

6.Is there a transition period when it comes to the substance carve-out?

6.在公式化經濟實質排除過程中是否有過渡期?

For the first 10 years, there is a transitional rule where the substance carve-out starts off at 8% of the carrying value of tangible assets and 10% of payroll costs. For tangible assets, the rate declines annually by 0.2% for the first five years and by 0.4% for the remaining period. In the case of payroll, the rate declines annually by 0.2% for the first five years and 0.8% for the remaining period.

對于前10年,有一個過渡規則,第一年,公式化經濟實質排除金額為有形資產賬面價值的8%和工資成本的10%。對于有形資產,這一比率在前5年每年下降0.2%,在剩余期間每年下降0.4%。對于工資,前五年每年下降0.2%,在剩余期間每年下降0.8%。

7.What are the next legislative steps?

7.下一步立法步驟是什么?

Member States will need to unanimously agree in Council. The European Parliament and European Economic and Social Committee will also need to be consulted and give their opinion. It is important to note that EU members of the OECD Inclusive Framework are already supporting the global agreement that the Commission proposal is implementing. The only EU Member State that is not a member of theInclusive Framework, and as such has not formally committed to the agreement,is Cyprus. However, we expect Cyprus to support the Directive.Up to now, EU’s path forward on global minimum tax is under debate, there presentatives expressed the hope to continue discussion in the upcoming March15 meeting.

會員國將需要在理事會中一致同意。還需要咨詢歐洲議會和歐洲經濟和社會委員會并發表意見。值得注意的是,OECD包容性框架的歐盟成員國已經在支持歐盟委員會提案中正在實施的全球協議。歐盟成員國中唯一一個不是包容性框架成員,塞浦路斯,沒有正式承諾參與該協議。然而,我們期望塞浦路斯支持該指導提案。到目前為止,仍在討論歐盟在全球最低稅的未來發展方向,代表們希望在即將到來的3月15日的會議上繼續討論。

特別提醒:非官方譯本,如有不同理解請以英文版為準。